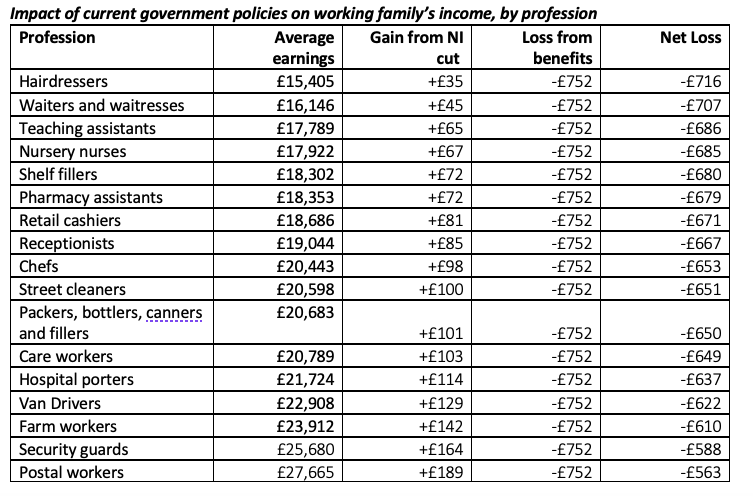

Analysis by the Child Poverty Action Group (CPAG) and Action for Children reveals the scale of income cuts workers in different jobs face if benefits are uprated by wages rather than the inflation rate, which is now at 10.1 per cent.

It finds that if benefits increase by earnings (5.5 per cent) instead of inflation (10.1 per cent), a low-earning couple with two children stand to lose £752 in 2023/24. Only a fraction of this will be offset by lowering National Insurance (NI) – one element of the former Chancellor’s mini-budget that remains in place. NI is to be lowered to 12 per cent instead of 13.25 per cent.

According to the analysis, parents in the lowest-paid jobs such as nursery staff, street cleaners and van drivers, will gain the least from NI cuts and therefore will see the biggest cumulative loss to their income.

The charities say that the Government has so far refused to confirm that it will honour the previous Government’s commitment to uprate benefits to match inflation.

According to their data (see table below), a nursery nurse earning an average of £17,922 a year, will gain £65 from the National Insurance (NI) cut, but would lose £752 in benefits, making them £685 worse off. Likewise, a teaching assistant on a £17,789 salary, is set to gain £65 from the NI cut, but would lose £752 from their benefits, making them £686 worse off. The figures are based upon a couple with two children (aged 6 and 2), where one adult works full-time, and who live in rented housing.

The analysis also shows that the more needs the family has, the more social security they stand to lose. For example, a working couple with two children where one partner is caring for their disabled child stand to lose over £1,000 if benefits are uprated by earnings rather than inflation.

It warns that these losses ‘risk being baked-in to future years’ - even if Government returns to uprating with inflation in future years, a couple with two children will continue to be £752 worse off in cash terms in each subsequent year if benefits don’t increase with inflation this year. The only way to avoid this, claim the charities, is for a future government to raise benefits at a rate higher than inflation.

‘Many more families will be pushed to the brink of survival without support.’

Chief executive of Child Poverty Action Group, Alison Garnham, said, ‘The UK is already trapped in a child poverty crisis – and many more families will be pushed to the brink of survival without support. The bare minimum Government can do is to confirm it will raise benefits in line with inflation. With so much uncertainty and fear, families are terrified, and it’s unthinkable that children will be forced to bear the brunt of the Government’s economic mistakes.

Director of policy and campaigns at Action for Children, Imran Hussain, commented, ‘Protecting children from hunger and harm is not an eye-wateringly hard decision. A cut in the true value of benefits would cause immense long-term damage to so many of the low-income parents and children we support who are already struggling to survive on the breadline.

‘The Chancellor has rightly said that economic stability is his most important objective – but that cannot come at the expense of the poorest. It's critical the Government keeps its previous promise to uprate benefits with inflation so those on the lowest incomes can afford to feed their children and heat their homes.’